Australian Mileage Rates 2024. Travel — mileage and fuel rates and allowances. Motorists who use their own cars for work will lose about $85 a year in tax claims when the australian taxation office updates its mileage rates from july 1.

The current irs mileage rates (2024) april 7, 2024. Motorists who use their own cars for work will lose about $85 a year in tax claims when the australian taxation office updates its mileage rates from july 1.

Motorists Who Use Their Own Cars For Work Will Lose About $85 A Year In Tax Claims When The Australian Taxation Office Updates Its Mileage Rates From July 1.

The 2024 medical or moving rate is 21 cents per mile, down from 22 cents per mile last.

The 2024 Standard Mileage Rate Is 67 Cents Per Mile, Up From 65.5 Cents Per Mile Last Year.

Australian residents tax rates 2020 to 2024.

The Automobile Allowance Rates For 2024 Are:

Images References :

Source: higion.com

Source: higion.com

Free Mileage Log Templates Smartsheet (2023), Mileage rate increases to 67 cents a mile, up 1.5 cents from 2023 internal revenue service (irs). Alexander ballantyne, avish sharma and tim taylor.

Source: linniewlou.pages.dev

Source: linniewlou.pages.dev

Irs Reimbursement Rate For Mileage 2024 Livvy Quentin, Alexander ballantyne, avish sharma and tim taylor. Rates for fuel acquired from 5 february 2024 to 30 june 2024.

Source: www.youtube.com

Source: www.youtube.com

Standard Mileage Rate Tax Deduction Explained! Save money on Taxes, 67 cents per mile driven for business use, an increase of 1.5 cents from 2023. Reflected in the above table are tax rate changes from the 2018 budget for the 2 years from 1 july 2022 to 30 june 2024, which include an expansion of the 19% rate to $41,000, and lifting.

Source: www.hrmorning.com

Source: www.hrmorning.com

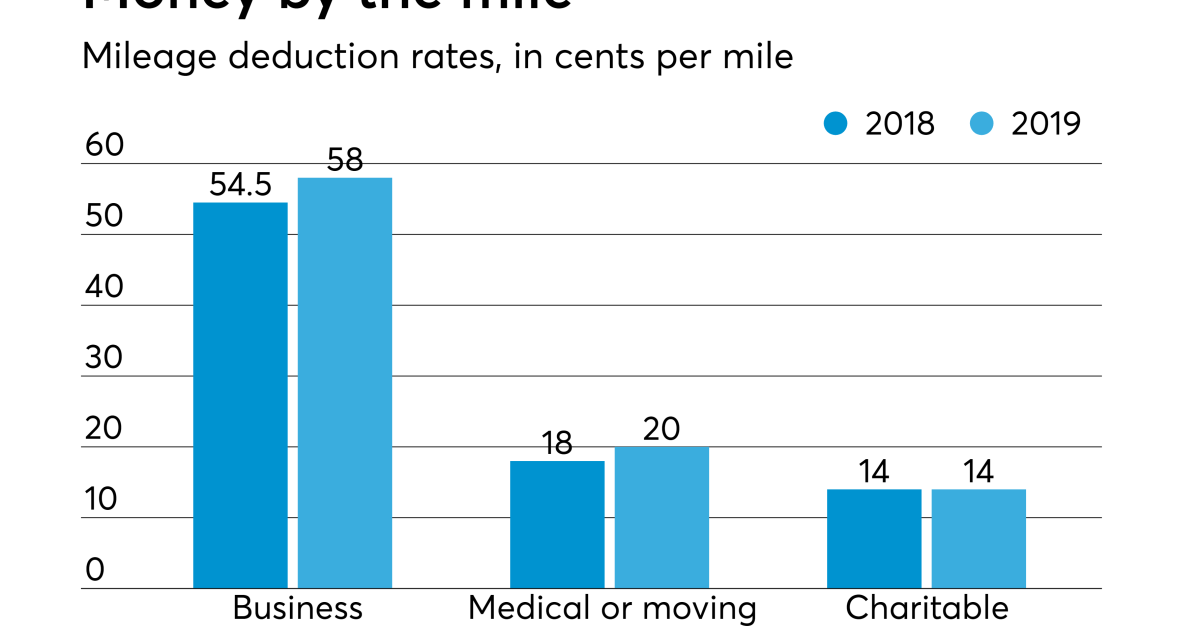

2023 standard mileage rates released by IRS, As of 16 february 2020, the average hourly rate for a business consultant in australia is $49.09 an hour with the minimum consultancy fees hourly rate at $25.49 while the top. “for these reasons we have modelled further interest rate increases of 0.25 per cent in may and june 2024.

Source: mileagereimbursement.blogspot.com

Source: mileagereimbursement.blogspot.com

Standard Mileage Reimbursement 2021 Mileage Reimbursement 2021, 67 cents per mile driven for business use, an increase of 1.5 cents from 2023. Australian residents tax rates 2020 to 2024.

Source: generateaccounting.co.nz

Source: generateaccounting.co.nz

New Mileage Rate Method Announced Generate Accounting, Learn more about the new cents per km 2023/2024 rate. 67 cents per mile driven for business use, an increase of 1.5 cents from 2023.

Source: www.haynesbserv.com

Source: www.haynesbserv.com

2022/2023 Mileage Rates, Sure, two inflation gauges that strip out some of more volatile price movers barely fell or were steady. In australia, business mileage reimbursement rates only apply to standard cars that are designed to carry less than one tonne and fewer than nine passengers.

Source: financiallevel.com

Source: financiallevel.com

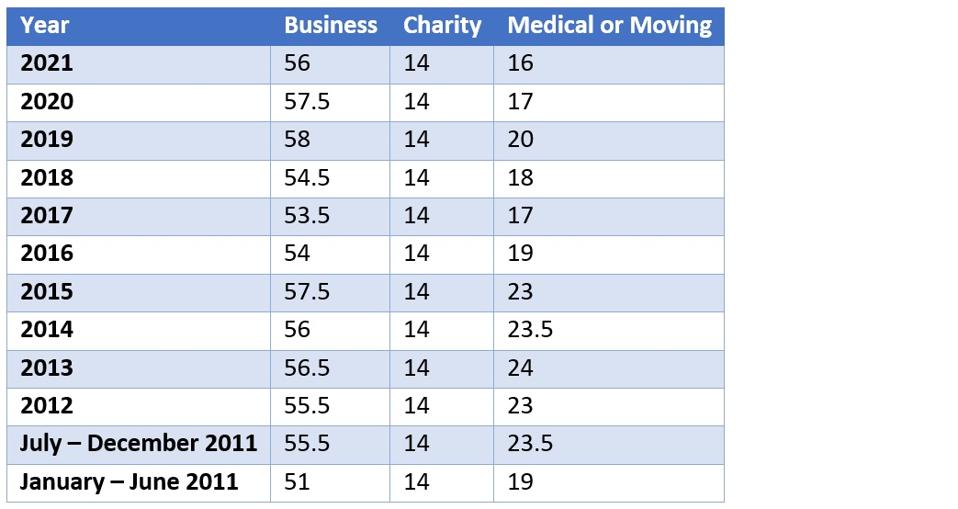

Table showing historical IRS mileage rates, Australian residents tax rates 2020 to 2024. “for these reasons we have modelled further interest rate increases of 0.25 per cent in may and june 2024.

Source: www.youtube.com

Source: www.youtube.com

2023 IRS Standard Mileage Rate YouTube, Motorists who use their own cars for work will lose about $85 a year in tax claims when the australian taxation office updates its mileage rates from july 1. If the rba raises interest rates by 0.25 per cent in may.

Source: fas-accountingsolutions.com

Source: fas-accountingsolutions.com

Standard Mileage Rates for 2023, “for these reasons we have modelled further interest rate increases of 0.25 per cent in may and june 2024. If the rba raises interest rates by 0.25 per cent in may.

Use 78 Cents Per Kilometre.

Motorists who use their own cars for work will lose about $85 a year in tax claims when the australian taxation office updates its mileage rates from july 1.

Mileage Rates In The Us:

Approved mileage rates from tax year 2011 to 2012 to present date.